Table of Content

- View All Consumer Products & Retail

- Data: The Price per Square Foot for Homes Has Quadrupled Since 1980

- Pregnant woman shot in suspected road rage incident in San Bernardino County

- Typical home price in Pennsylvania: $267,549 (62% of typical U.S. price)

- Affordability Makes or Breaks Home Searching in 2023

Existing, single-family home sales are forecast to total 416,800 units in 2022, a decline of 5.2 percent from 2021’s projected pace of 439,800. A supply-demand imbalance will continue to put upward pressure on prices, but higher borrowing rates and partial adjustment of the sales mix will likely limit the median price rise. Looking at the current market shift, C.A.R. has reduced its 2022 housing prediction.

This was up from the near-steady trend that prevailed before the pandemic as workplace flexibility soared. In 2022, even though many workers are returning to offices, cross-market shopping has climbed to new heights, accounting for nearly 61% of page views in the third quarter. Our second quarter study offers a revealing explanation for the trend, especially among shoppers in the Northeast and West. More than 7 in 10 cross-market shoppers from these regions were looking at homes in areas 10% or more cheaper than their current location. Relocating may not be an option for all home shoppers, but for those with the flexibility, 2023 may be a time to explore.

View All Consumer Products & Retail

Let’s take a look at the average house price in each state as of April 2021. Average mortgage payments were calculated based on a 12% down payment and using the typical home prices and the average mortgage rates for each area as of July 2022. Wisconsin offers a good combination of reasonable home prices and a median income just 1% less than the U.S. median.

The homeownership rate is also among the highest in the nation, at 74.8%. However, Mississippi also has the nation's highest poverty rate, with a fifth of its inhabitants living below the poverty line. The number of newly listed homes was 19,182 and down 31.2% year over year.

Data: The Price per Square Foot for Homes Has Quadrupled Since 1980

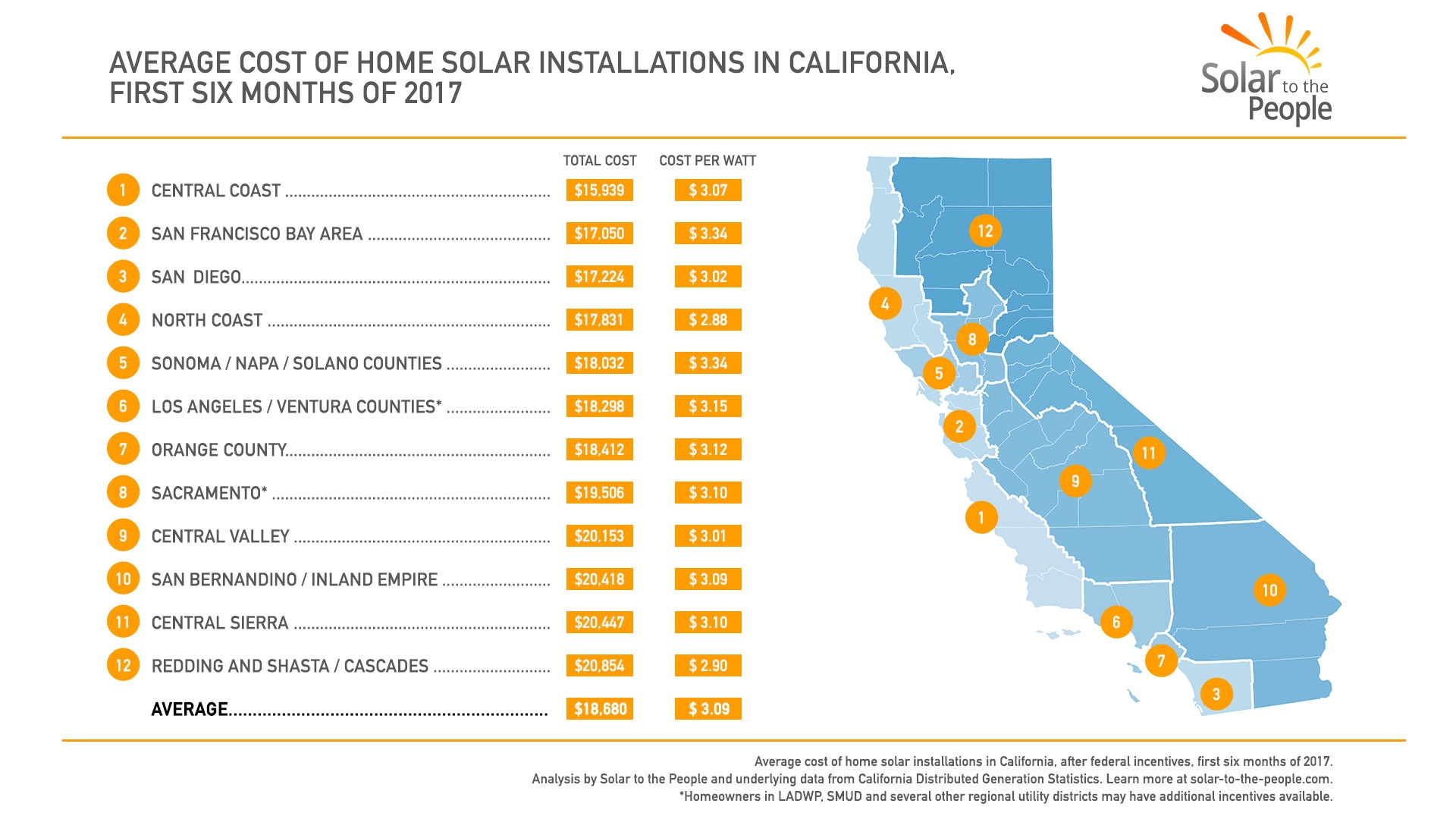

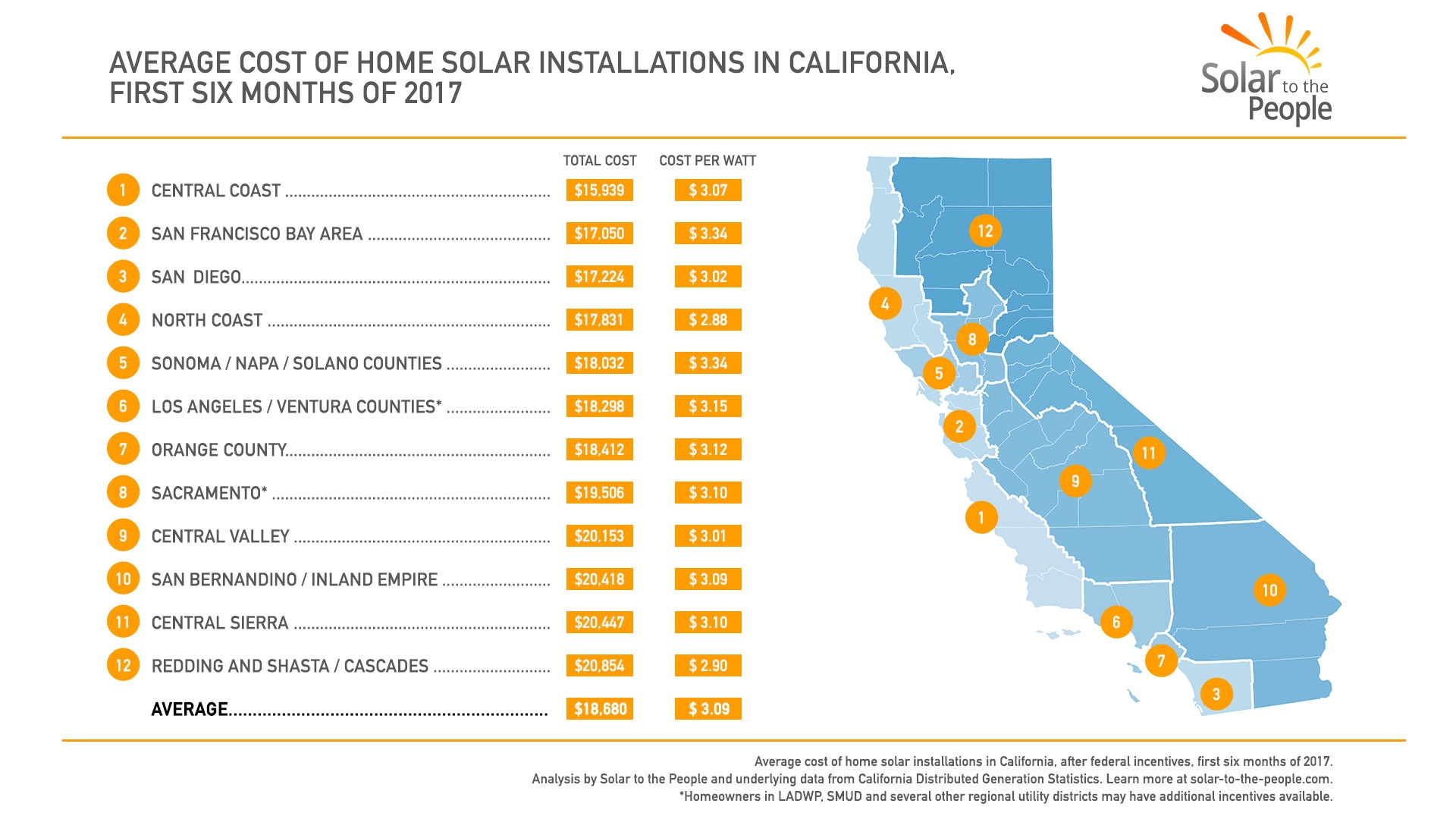

The average sale price per square foot in Bakersfield is $208, up 3.0% since last year. Housing inventory in California continued to rise both month-to-month and year-to-year as the market entered its holiday season and home sellers remained on the sideline. The statewide unsold inventory index was unchanged from the prior month at 3.3 months in November, but it was more than doubled the level of 1.6 months recorded in the same month of last year. Sharp declines in housing demand continued to apply downward pressure on home prices as median prices in three of the five major regions dropped mildly from a year ago. San Francisco Bay Area experienced the biggest price decline from last year at -5.8 percent, followed by the Far North (-3.7 percent) and the Central Valley (-1.3 percent).

Another spot to check out is Branson—it’s a hot spot known for its music scene and over-the-top Christmas celebrations. The average purchase price of a home in Ole Miss is $135,743—a 5.5 percent increase from last year. Whether you’re in Biloxi or Natchez, there’s plenty to see, do, and soak up in the way of cuisine and natural beauty. Wyoming has less-expensive homes than the norm, and earnings are only 4% lower than the median income. It still doesn't manage to pass the 28% rule, even though it's fairly close.

Pregnant woman shot in suspected road rage incident in San Bernardino County

Lower average house prices in Georgia make it a budget-friendly place to own a home, even though the median income comes in 13% below the rest of the country. Mortgage payments take up a big chunk of homeowner' 'budgets in Arizona. That's due to a combination of high housing costs and a median income 1% below the national median. Oregon's homeownership rate, at 64.3%, is slightly lower than the national average. Home sizes are also slightly below average, with a typical unit measuring 1,780 square feet. One way people are bringing down the cost of purchasing a home is by relocating.

Despite an overall improvement in housing supply conditions, six counties registered a contraction in active listings from the same month of last year. Del Norte continued to have the largest decline in November with a drop of 35.6 percent year-over-year, followed by Mono (-33.3 percent) and Glenn (-10.0 percent). Home sales have been on a downward trend for 17 straight months on a year-over-year basis. It was the fourth time in the last five months that sales dropped more than 30 percent from the year-ago level. The monthly 13.2 percent sales decline was worse than the long-run average of -0.5 percent change recorded between an October and a November in the past 43 years.

Top 10 Metros in California with the Fastest Growing Sales Price

April home sales increased on a monthly basis for the third consecutive month, rising 2.6% from 446,410 in March and up 65.1% from a year ago. The sharp yearly sales jump was expected as the housing market was hit hard by the coronavirus shutdown last year, when home sales dropped more than 30% over the previous April. Meanwhile, closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 458,170 in April. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the April pace throughout the year. While the price growth in Southern California was not as strong as that of the Bay Area, the increase was still robust. All counties increased on a year-over-year basis by at least 4.5 percent with Los Angeles rising the most at 12.1 percent.

It indicates that 50 percent of all housing stock in the area is worth more than $769,405 and 50 percent is worth less . Existing, single-family home sales are forecast to total 333,450 units in 2023, a decline of 7.2 percent from 2022’s projected pace of 359,220. The Far North (-37.7 percent) recorded the smallest sales declines among the five major regions in California. NerdWallet's star ratings for mortgage lenders are awarded based on our evaluation of the products and services each lender offers to consumers who are actively shopping for the best mortgage.

All price segments continued to decline by 30 percent or more year-over-year, with the $2 million plus price segment falling the most at 47.7 percent. The median home price in California declined for the third straight month in November — 3.0 percent in November to $777,500 from the $801,190 recorded in October. However, mortgage rates are a major factor in the calculus of housing affordability, and lower than expected rates are a positive risk factor. In 2013, the annual tally for existing home sales finally surpassed 5 million after 5 years below that threshold following the unwinding of the housing boom of the mid-2000s. By 2015, existing home sales totaled 5.25 million and in the subsequent four years the annual total fluctuated modestly between 5.25 and 5.51 million homes sales. Without adjusting for inflation, millennials entering their 30s face a 161% higher median sale price per square foot of house than boomers at the same age.

The average price for a home in Delaware is $285,750, up 10.3 percent over the past year. Some cities to look into include Claymont, which has an average home value of $244,484, Wyoming, which as an average home price of $202,479, and Ocean View, which has an average home price of $369,740. Zillow reports that Alaska home values have increase 1.2 percent over the past year. With earners in South Dakota making 3% more than the national median and low housing prices, the average home payment in South Dakota doesn't take up too much of residents' budgets. New Jersey is home to high housing costs and high salaries (31% more than the national median).

Buying a home in New Hampshire is doable, but many residents will find it challenging. Although the median income beats the U.S. median by 31%, the typical home price still leads to expensive mortgage payments. Nebraska ranks as one of the better states for home affordability.

At the county level, home prices continued to rise across the state, with 26 counties in California setting new record median highs in April. Forty-five out of 51 counties tracked by C.A.R. recorded a price increase in April, with 33 of them rising 10 percent or more from a year ago. Mono had the biggest year-over-year gain in median price at 142.6 percent, followed by Marin (31.2 percent) and Mariposa (23.3 percent).

The average home price in Michigan is $196,088—a 10.6 percent increase over the past year. If you’re looking at Ann Arbor, expect to see houses listed for around $408,000. If you’re looking at Grand Rapids, expect a lower average home price at $272,446. The average home price is $142,225, which has gone up 7.3 percent from last year.

No comments:

Post a Comment